The Union Budget for the Financial Year 2025-26 was presented by the Finance Minister Mrs. Nirmala Sitharaman in the Lok Sabha today. Among many announcements made during the Union Budget 2025 presentation, Finance Minister Mrs. Nirmala Sitharaman proposed exempting individuals earning up to Rs. 12 lakhs annually from paying income tax, the move is aimed at providing relief to the middle class and boosting disposable income, was among the key highlights of a budget that promises transformative reforms across multiple sectors.

Other major highlights of the Budget Speech are as follows: —

1. New Income Tax Bill to be proposed Next Week;

2. Customs protocols to be eased;

3. To Enhance investments, Turnover Limits, Credit limits of MSMEs revised;

4. Revamped KYC portal to be launched in 2025 Budget;

5. Govt to decriminalize more offences;

6. Rationalization of Tariff Rate Structure under Customs:

Ø Remove 7 Tariff Rates

Ø Apply Cess on a few Items

Ø Levy not more than one surcharges on goods subject to cess

Ø Full Exemption of BCD on Life saving medicines and patient assistance programmes run by Pharma companies where assistance is free

7. 35 additional Capital Goods for Mobile Phone Manufacturing to be Exempted from BCD;

8. 2 years’ Time Limit to finalize provisional Customs Assessment;

9. Penalty to be removed on Voluntary confession of tax evasion Not applicable to audit cases already initiated by Tax Dept;

10. TDS: Threshold amount will be increased; Tax rates will be revised;

11. TDS on Annual Rent to be increased to 6 Lakh Rupees;

12. TCS not applicable on Remittance for certain Education purposes;

13. Higher TDS applicable on non-PAN cases;

14. Time limit for updating ITR for Voluntary compliance by Taxpayers increased to 4 years;

15. Two self-occupied properties conditions exempted from income tax;

16. Scope of safe harbour Rules to be expanded;

17. Digitalization is operational now to resolve income tax disputes;

18. Delay for payment of TCS up to due date to be decriminalised;

19. Compliance burden on small charitable trusts and institutions reduced; and

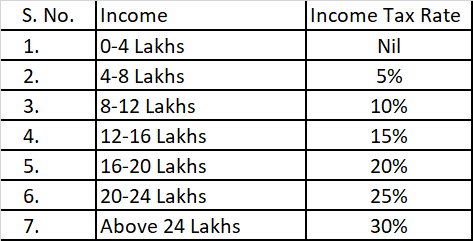

20. Personal Income Tax changes: -

No Income Tax up to 12 Lakhs Rupees, thus no Income Tax up to Rs.12.7 Lakhs to salaried class due to Rs.70,000 Standard Deduction;

New Income slabs: -